Julien Dias is a dedicated professional with strong experience in Renewable Energy, with an emphasis on Project Finance, Corporate Finance, Structured Finance, Mergers & Acquisitions and Carbon Finance.

As an independent advisor, I am fully committed to customer projects, offering a differentiated and unique service:

with great agility, flexibility, and adding value to the project.

ABOUT JULIEN DIAS

As an entrepreneur that has successfully opened one of the first Solar Power companies in South America in early 1990s, Solar Brasil (www.solarbrasil.com.br), I have experience in a wide variety of situations living in different cultural environments and working for several multinational and financial companies such as: Santander Bank, Saint-Gobain and Orbitall (Citigroup).

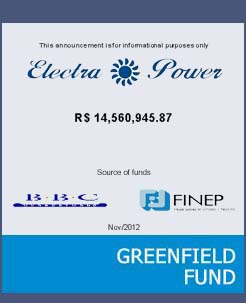

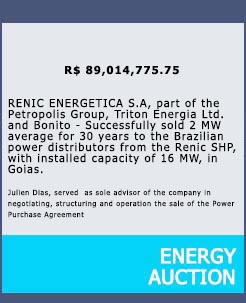

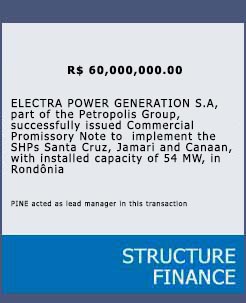

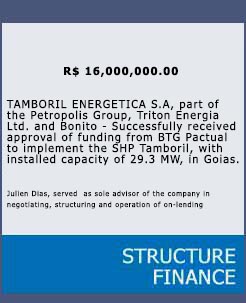

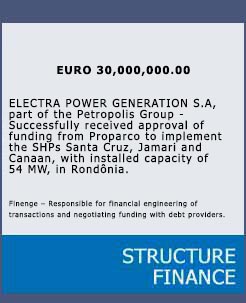

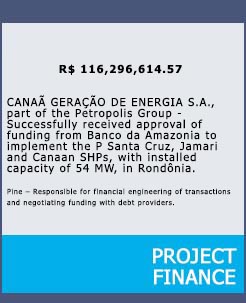

In the last 15 years I have been dedicated to renewable energy and climatic changes in which I had the opportunity to work for Brookfield Energy and Electra Power (Petropolis Group), solving different types of problems and working with strict deadlines.

This unique experience gave me the necessary skills to see issues not as problems but as opportunities. I have deeply committed myself to overcome any obstacle and learn from them, and use those particular moments to sort out new issues and add experience.

I blend my professional experience with a strong academic background, undertaking an MBA in Finance at IBMEC, São Paulo-BR and a Certificate in Finance with Mathematics at Birkbeck College, London-UK.

In recognition of my dedication and work in the renewable energy sector and climatic change, I was invited to be a representative in the Brazilian delegation at COP-15 and Rio+20.

More information about Julien Days visit: br.linkedin.com/in/diasjulien

WHAT WE DO

We advise clients on mergers & acquisitions, debt and equity funding, and strategy in energy and forest products related markets. Our clients include energy companies, financial institutions, project developers and investors.

Our expertise in energy allows us to understand the value drivers associated with renewable energy and clean technology assets in dynamic and evolving policy environments.

Advisory Clients

We provide strategies, corporate finance, M&A, and project finance consulting to the following institutions:

Products And Services:

Project Origination

We engage with investors, renewable energy manufacturers and energy companies to source projects ranging from permitted Greenfield development opportunities to construction-ready projects.

Our services involve all stages of a transaction, from strategic planning phase, including defining the scope of the transaction, preparation of agreed upon materials, and analysis

of opportunities and business plans, through project execution, including contacting targets, performing valuation analysis and due diligence, and undertaking and closing negotiations.

TRAINING

Project Finance Modelling

Designed to appeal to project sponsors, bankers and advisors, Best Practice Project Finance Modelling is essential to improve your ability to build, review or analyse project finance models at all levels.

Best Practice Project Finance Modelling will give you the tools you need to build and sensitise robust and transparent cashflow based financial models and dramatically increase your Excel efficiency. During the financial modelling course you will, under personal coaching from our expert trainer, build your own project finance model from scratch.

This project finance modelling course will enable you to:

Who should attend this course focused on Project Finance Models?

This course is suitable for anyone who needs to build, review or analyse project finance models. Typical attendees include Analysts, Managers, Senior Managers and Associate Directors.

Energy Project Finance

Despite the impacts of the “credit crisis”, the energy sector remains one of the key industry sectors for Project Finance markets. This course will improve participants understanding of the Project Finance opportunities in the Brazil energy markets through exploring the key drivers for the growth in demand and production of energy. Principles and issues relating to Project Finance will be illustrated using a wide range of current and historic case studies and examples from the Course Director’s own experience of the global energy sector.

The impact of the “credit crisis” on the funding of energy sector projects will be considered, including a review of alternative financing sources, including the use of export credit and multilateral/bilateral agencies and capital markets as a source of potential Project Finance funding.

This Energy project finance course will enable you to:

Who should attend this course focused on Energy Project Finance?

This course is suitable for anyone who want to invest in renewable energy or is looking for funding. Typical attendees include Analysts, Managers, Senior Managers, Associate Directors, Investor and entrepreneurs.

Introduction to Carbon Markets

This course will provide a comprehensive overview of carbon markets, from their origins in global efforts to address climate change to the details of regional emissions trading programs. The lessons in this course will provide you with a general knowledge of climate change policy and the effects of treating greenhouse gas emissions (i.e., carbon) as a tradable commodity. It will expose you to details of Europe’s carbon trading programs and regional carbon markets emerging in North America, as well as the rules of credit trading under the Kyoto Protocol.

You will benefit by understanding the economic principles of emissions cap-and-trade policies, the history on the United Nations Framework Convention on Climate Change (UNFCCC) and the Kyoto Protocol, what policies countries are implementing to cut their greenhouse gas emissions, carbon offsets and offset projects, the European Union’s emissions trading system, regional carbon trading regimes and voluntary carbon markets.

This course is jointly developed by Acend Brasil.

Introduction to Carbon Markets course will enable you to:

Who should attend this course focused on Introduction to Carbon Market?

This course is suitable for anyone who want to understand Carbon Credit Market and the impact on investing in renewable energy Project. Typical attendees include Analysts, Managers, Senior Managers, Associate Directors, Investor and entrepreneurs.

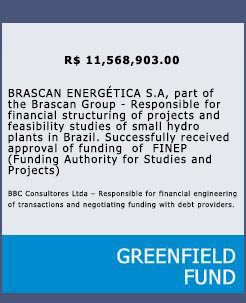

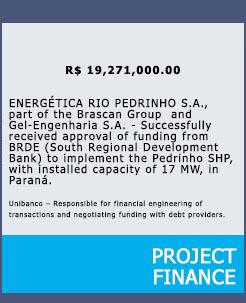

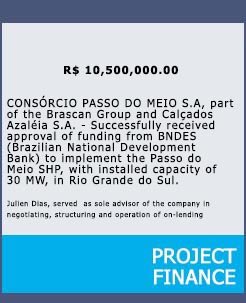

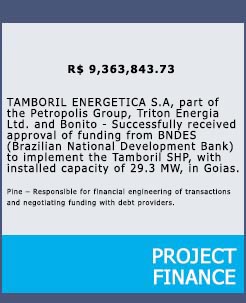

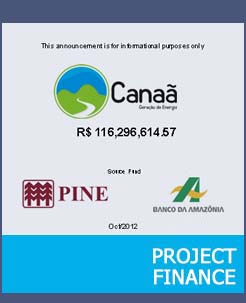

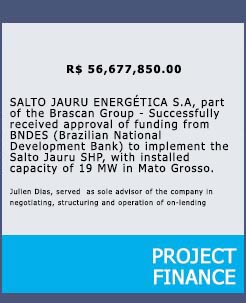

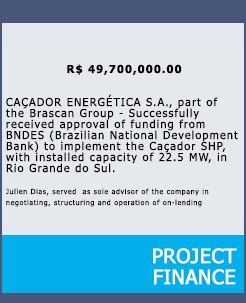

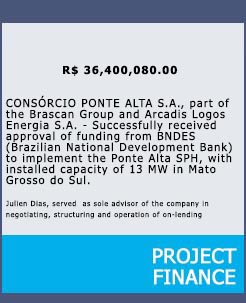

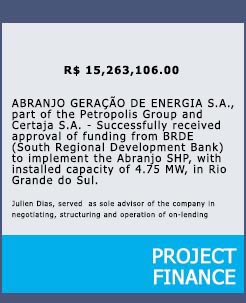

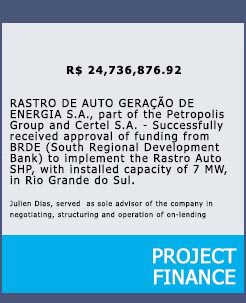

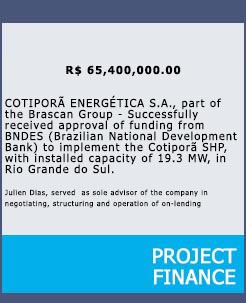

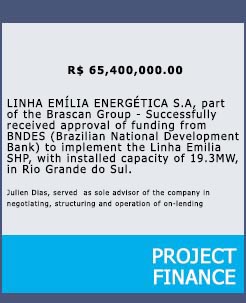

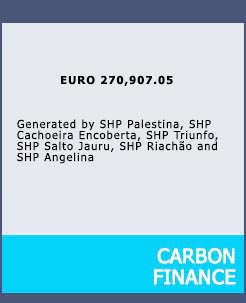

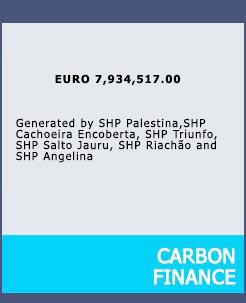

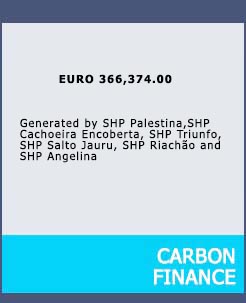

OUR WORK

CONTACT US

By E-mail

![]() juliendias@hotmail.com

juliendias@hotmail.com

By Skype

![]() juliendias@hotmail.com

juliendias@hotmail.com